In the arena of health insurance, things are always changing. Those changes may be about what type of care is covered, who is eligible for that care or how much patients have to pay

Staying on top of those changes can feel challenging for patients and caregivers.

It is no different navigating changes to Medicare coverage. Medicare is a federal health insurance program that covers more than 65 million Americans. Each year, there are changes to Medicare costs, and people who have Medicare must choose from various Medicare plan options.

In addition to these annual changes, the Inflation Reduction Act (IRA), passed in April 2022, included changes to Medicare Part D that may benefit the cancer community.

Parts of Medicare

Medicare coverage is broken down into four parts:

- Part A of Medicare is hospital insurance. It includes coverage for care received in the hospital and hospice care. It also provides limited coverage for skilled nursing facilities, nursing homes and home health care.

- Part B of Medicare is medical insurance. It includes coverage for items such as outpatient services, preventive care, labs, mental health care, ambulances and durable medical equipment. It also covers intravenous chemotherapy.

- Part D of Medicare covers prescription drugs. Medicare Part D plans are separate plans sold by Medicare-approved private insurance companies.

- Part C of Medicare, also referred to as Medicare managed care plans or Medicare Advantage plans, provide an alternative to Original Medicare (Parts A and B). Medicare Part C plans are managed care plans sold by Medicare-approved private insurance companies. They include the benefits and services covered under Parts A and B, and usually Part D.

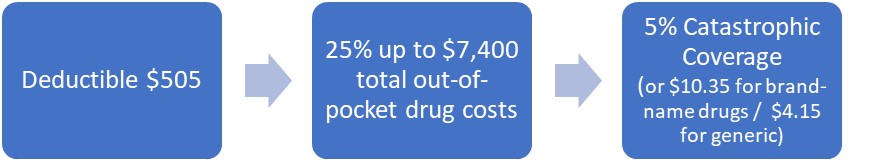

How a Part D Plan Works

In 2023, a standard Part D plan was structured with a maximum annual deductible of $505. After paying the deductible, patients would pay 25% of their drug costs until their out-of-pocket costs reached $7,400. Then, patients would enter catastrophic coverage, paying the greater of two costs: either 5% of drug costs, or $10.35 for brand-name drugs and $4.15 for generics for the rest of the year. There was no out-of-pocket maximum for Part D prescription drug costs.

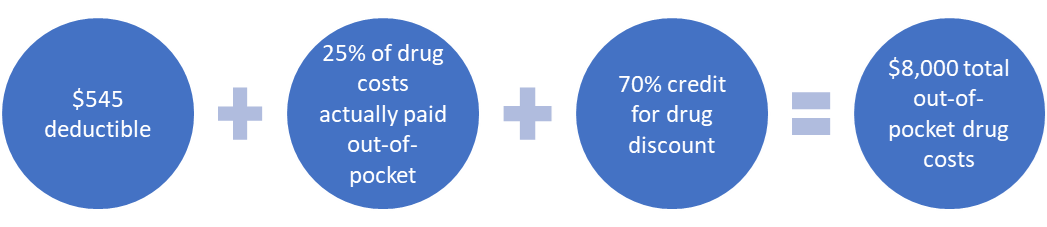

IRA Changes to Medicare

In 2024, the structure of the standard Part D drug benefit changed as a result of the IRA. Patients now pay the maximum annual deductible of $545. Then, they pay 25% of their drug costs and get a credit for 70% of the price of their brand-name drugs until their combined out-of-pocket costs and credits reach $8,000 (aka “total out-of-pocket drug costs”). Then, they have no additional out-of-pocket costs for Part D prescriptions for the rest of the year.

This means that individuals who take only brand-name drugs in 2024 will reach the $8,000 catastrophic coverage threshold by actually spending a total of $3,333 out-of-pocket.

If this sounds complicated, that is because it is. The brand-name discounts and the math involved are creating a lot of confusion. It is important to realize that this math is going to look different for patients who are taking generic drugs.

If you would like to understand more about the math involved, read Triage Cancer’s blog on Medicare changes.

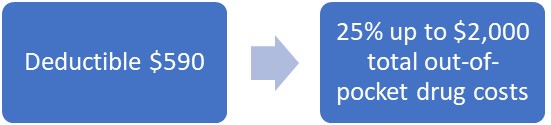

In 2025, patient out-of-pocket drug costs will be simplified. Patients will pay a deductible of $590 and then will pay 25% of their drug costs, until they have spent a total of $2,000 out-of-pocket. Then, they will have no additional out-of-pocket costs for Part D prescriptions for the rest of the year.

Also starting in 2025, individuals will have the ability to spread out their out-of-pocket prescription drug payments over the year, rather than face high out-of-pocket costs in a single month. For example, if a patient takes an expensive brand-name drug in January, instead of paying the full $2,000 out-of-pocket cost in January, they can make payments of $167 a month, from January through December. We are waiting on final details from the Centers for Medicare and Medicaid Services on how this process will work.

Educating Yourself

Patients who understand how to navigate the changes to Medicare will not only improve their access to the care they need, but also mitigate the financial burden of a cancer diagnosis.

Still, even though the Part D changes in the IRA will substantially decrease the maximum amount patients have to pay out-of-pocket for their prescription drugs, many patients will still find it financially challenging to afford $3,333, or even $2,000. Programs and resources are available to help patients offset those expenses, such as Medicare’s Extra Help Program, state pharmaceutical assistance programs and private organizations that provide financial assistance.

Learn more about Medicare and cancer.

Triage Cancer is a national, nonprofit organization that provides free education on the legal and practical issues that may impact individuals diagnosed with cancer and their caregivers, through events, materials, and resources, including a Legal & Financial Navigation Program.

© Triage Cancer 2024

Cancer Today magazine is free to cancer patients, survivors and caregivers who live in the U.S. Subscribe here to receive four issues per year.

Disclaimer: Sponsored advertising content is written by the advertiser and does not necessarily reflect the views of Cancer Today or the American Association for Cancer Research (AACR). Cancer Today’s editorial staff was not involved in developing or creating the sponsored content. Content on the Cancer Today website is not intended to be a substitute for professional medical advice. For diagnosis or treatment of any medical condition or any questions you may have about a medical condition, please consult your physician or other qualified health care provider. Neither Cancer Today nor the AACR is liable for any loss or damage incurred as a result of reading or following the information or engaging with any of the advertising or sponsored advertising content on the Cancer Today website. The mention of any company, service, product or treatment does not constitute an endorsement by Cancer Today or the AACR.